Authors:

- Benoît GomisEmail Benoît Gomis

- Allen W. A. Gallagher

- Raouf Alebshehy

- Andrew Rowell

Abstract

Previous research has documented how British American Tobacco (BAT) and other transnational tobacco companies (TTCs) smuggled their own products into Iran in the 1990s in order to circumvent sanctions and other trade restrictions. In the early 2000s, BAT, along with other TTCs, signed legal agreements with Iranian authorities to sell its products legally and curb illicit tobacco trade (ITT). Our analysis of previously unreleased internal BAT documents (covering 2000–2014) suggests BAT remained potentially involved in ITT after those agreements were signed. Meanwhile, BAT engaged with government authorities to tackle ITT primarily for reputational and commercial purposes. With a business model based on a high number of contractors and distributors, extensive engagement with government authorities, and an anti-illicit trade strategy focusing more on reputation and growth than on effectively controlling its supply chain, further investigation into BAT’s activities in Iran – including potential sanctions breaching – may be warranted. This is especially relevant as, in April 2023, BAT agreed to pay penalties exceeding US$629 million to resolve charges of bank fraud and sanctions violations in North Korea, following a criminal investigation by the US Department of Justice and Office of Foreign Assets Control. Exploration of BAT’s activities in Iran would provide insight into the credibility of BAT’s response following these penalties, with the company having claimed that “Adhering to rigorous compliance and ethics standards has been, and remains, a top priority”.

Introduction

Previous research has documented how transnational tobacco companies (TTCs) relied on illicit tobacco trade (ITT) in the 1990s to circumvent trade restrictions and other sanctions in Iran (WHO 2001; WHO 2003). In the early 2000s, import bans were lifted and the state tobacco authority signed an agreement with four TTCs, including British American Tobacco (BAT), allowing them to legally import and produce their products locally in order to reduce ITT (Table 1) (Puckett 2003). Little is publicly known on BAT and other TTCs’ business and political strategies since then, including the extent of their involvement in illicit activities in Iran from the 2000s onwards, and the nature of their relations with national authorities.

Table 1

Key events in BAT’s history in Iran.

| DATE | EVENT |

|---|---|

| 1990s | BAT and other TTCs are involved in smuggling as part of market entry strategy into Iran (WHO 2001; WHO 2003). |

| 1999–2001 | Import ban on foreign tobacco products is lifted (WHO 2001; WHO 2003). |

| February 2001 | BAT begins operating legally (BAT 2011a). |

| 2002 | Iranian Tobacco Company (ITC) signs agreements with Reemtsma (Imperial Tobacco subsidiary in Germany), BAT, Japan Tobacco International (JTI), and Korea Tobacco & Ginseng (KT&G) to sell their products legally in Iran (Albawaba 2002; GlobalData 2020). |

| 2002–2003 | BAT invests US$14 million into an ITC facility to manufacture Montana cigarettes (GlobalData 2020). |

| October 2003 | BAT’s subsidiary in Iran – BAT Pars – is established (BAT 2011a). |

| 2004 | Montana (BAT brand) production begins (GlobalData 2020). |

| 2010 | BAT begins joint manufacture of Pall Mall cigarettes with ITC (BAT 2011a). |

| 2010–2015 | Significant growth in BAT legal sales volume and market share, from 17.8% in 2009 (GlobalData 2020) to 33.4% in 2015 (WHO 2017). |

| 2016 | UN sanctions are lifted. |

| 2018–2019 | US Government (re-)imposes sanctions against Iran (CRS 2022). |

| 2018 | Iranian government puts in place a ban on all foreign cigarette imports (Financial Tribune 2018). |

| 2021 | BAT “agree[s] to dispose of” BAT Pars, selling the Iranian subsidiary to DTM ME FZE LLC (the UAE Free Zone-based Middle East branch of the DTM Group, headquartered in Germany) (BAT 2023a). |

BAT’s 2019 annual report stated that the company “ha[d] been liaising with the DOJ [Department of Justice] and OFAC [Office of Foreign Assets Control] in the United States, which are conducting an investigation into suspicions of breach of sanctions” (BAT 2020a). The report noted that the company has “operations in a number of countries that are subject to various sanctions, including Iran and Cuba”, before warning: “The potential for fines, penalties or other consequences”(…), “cannot currently be assessed but may be material” (BAT 2022).

In July 2022, BAT reported it had set aside £450 million towards the resolution of the investigation, before adding “it cannot be excluded that the amount of any potential settlement (…) may vary from this amount”, and cautioning: “Although the Group is working to resolve the government investigations through settlement, there can be no assurance that these efforts will be successful or, if they are, what the timing or terms of any such settlements would be” (Brasseur 2022; The Times 2022; BAT 2022).

On 25 April 2023, the U.S. Attorney’s Office for the District of Columbia announced that BAT had “agreed to pay penalties totalling more than $629 million to resolve bank fraud and sanctions violations charges with U.S. authorities” (DOJ 2023b). The press release noted that after publicly stating it was no longer involved in North Korea in 2007, BAT in fact continued conducting business in the country until at least 2017, and “maintained control over all relevant aspects of the North Korean business” (Financial Times 2010). This led to approximately $US415 million in banking transactions from North Korea to BAT (Financial Times 2010). The case file points to “Company 1” acting as a “middleman” to transfer money back from the illegal North Korea operations to BAT and BAT Marketing Singapore (D.D.C. 2023). Though the name of “Company 1” is not revealed in the documents, it is described as a “Singaporean conglomerate that supplies a variety of goods to various Asian markets”, appointed in 2005 by BAT Marketing Singapore as distributor to North Korea and other markets in Asia (D.D.C. 2023). BAT’s North Korean subsidiary was then sold to “Company 1” in August 2007. Media reports at the time identified that buyer as SUTL (Kollewe 2007). SUTL has repeatedly faced smuggling allegations dating back to the 1990s, yet continues to be a main distributor for BAT across Asia (Financial Times 2010; BAT 2023a; Tobacco-Free Kids 2002).

In a news release on the same day, BAT stated it had “reached agreement” with DOJ and OFAC, with BAT CEO Jack Bowles declaring the company “deeply regret[s] the misconduct arising from historical business activities”, pointing that “[a]dhering to rigorous compliance and ethics standards has been, and remains, a top priority for BAT” (BAT 2023a). This suggests the scheme was a one-off incident, not part of a broader pattern.

Yet, BAT has recently operated in several countries subject to sanctions, which warrants further examination. For instance, BAT continued to operate in Russia for 18 months after it first announced it would leave the country, upon public pressure over the invasion of Ukraine – before selling its business to a group led by senior BAT Russia executives (Proactive Investors 2022; Mitra & Husain 2023; BAT 2023b; BAT 2023c). In September 2021, following the imposition of international sanctions, BAT announced that it would stop partnering with Grodno Tobacco Factory Neman to abide by sanctions (Milmo 2021). Up until that point, the factory manufactured BAT brands under a license agreement, in addition to producing other brands (such as Minsk, NZ, and Fest) known for being smuggled across Europe for years (Crawford 2016; Yarashevich et al. 2021; Liutkutė-Gumarov et al. 2023; European Parliament 2017). After the announcement, BAT continued to produce and distribute cigarettes in Belarus until at least September 2023 (including, from December 2022, through International Tobacco Marketing Services (ITMS). BAT later sold its Russian and Belarusian businesses to the ITMS Group) (Gallagher & Gomis 2021; BAT 2023b; ITMS 2023). In October 2021, BAT stated that it would leave Myanmar, years after the military launched a deadly crackdown on Rohingya Muslims (Petty 2021), and months after it staged a deadly coup (BAT 2023c).

It is therefore worthwhile to delve into the extent to which the activities involving sanctions breaches in North Korea reflect broader issues within the company and its operations in other countries. In this paper, we leverage our access to internal BAT documents related specifically to Iran – a country that has also faced an array of major international sanctions for decades.

In 2007, when announcing its departure from North Korea, a BAT spokeswoman said this was “purely a commercial decision”, not pertaining to political pressure or the changing legal context (Kollewe 2007). In contrast, US authorities stated that BAT, who continued operating in the country secretly for a decade, in fact terminated its official activities “as required by U.S. sanctions” (DOJ 2023a). BAT’s 2021 annual report announced it “had agreed to dispose of” its subsidiary in Iran, with a sale to DTM ME FZE LLC agreed on in August 6th 2021 (BAT 2020b), painting this development in a negative light: “Revenue in 2021 was also negatively impacted by the sale of the Group’s operations in Iran, part way through the year”, but providing no context as to the reasons behind the sale (BAT 2023a).

Leaked internal documents help shed light on the company’s expansion strategy in Iran, the potential participation of BAT and other TTCs in ITT, the misleading functions of BAT’s anti-illicit trade (AIT) efforts, and other questionable business and political practices. As these documents were previously unreleased, this is the first study of its kind.

Trade sanctions are by nature political. OFAC points out that “sanctions can be either comprehensive or selective, using the blocking of assets and trade restrictions to accomplish foreign policy and national security goals” (TREAS 2023). As such, our aim is not to assess the political legitimacy or validity of sanctions, nor to identify the specific sanctions BAT ran the risk of potentially breaching in Iran, since the US first imposed sanctions on Iran back in 1979. Rather, we intend to document BAT’s little-known activities in Iran and to explore these within the context of the recent criminal investigation by DOJ/OFAC on BAT in North Korea, and of BAT’s operations in other similar environments.

Methods

Data collection

The authors searched a set of approximately 15,000 internal BAT documents (spanning 2000–2014) leaked by a former BAT employee working with anti-illicit trade (AIT) across parts of Africa and the Middle East. Using the search word ‘Iran*’ on a secure document review platform, 231 documents were identified, read, and reviewed. Documents were considered relevant if they included information on BAT’s activities in Iran. Following the exclusion of irrelevant documents and duplicates, 29 documents were selected for analysis.

Data analysis

Qualitative thematic analysis, based on a hermeneutic approach to company document analysis (Cassell et al. 1994; Gallagher et al. 2019) was applied to all documents, with analysis focusing specifically on

- BAT’s potential collusion in ITT in Iran and

- BAT’s engagement strategy with national authorities.

This method involves understanding the meaning of each document first and then identifying sub-themes within them. In this case, sub-themes include BAT’s supply chain in Iran, the role of duty-free products and free trade zones, BAT’s competitors in Iran, and specific interactions with authorities regarding AIT. Those sub-themes were then explored to identify collections of documents which overlap thematically, and these documents were then grouped together. Key findings were cross-referenced with other documents within each cluster for validation. These subsequent findings were later examined in the context of the initial research questions, and collective exploration was conducted to ensure validity and representativeness of the clusters.

Triangulation

Following this, documents were then recontextualized and triangulated using other sources of data; in this case, publicly available information. Here, the authors searched online news media (using Google), academic literature (Google Scholar), non-governmental organisation reports, publications from national governments (e.g., UK) and international organisations (e.g., WHO), Truth Tobacco Industry Documents, as well as tobacco industry websites (in particular BAT and its relevant subsidiaries and distributors).

Results

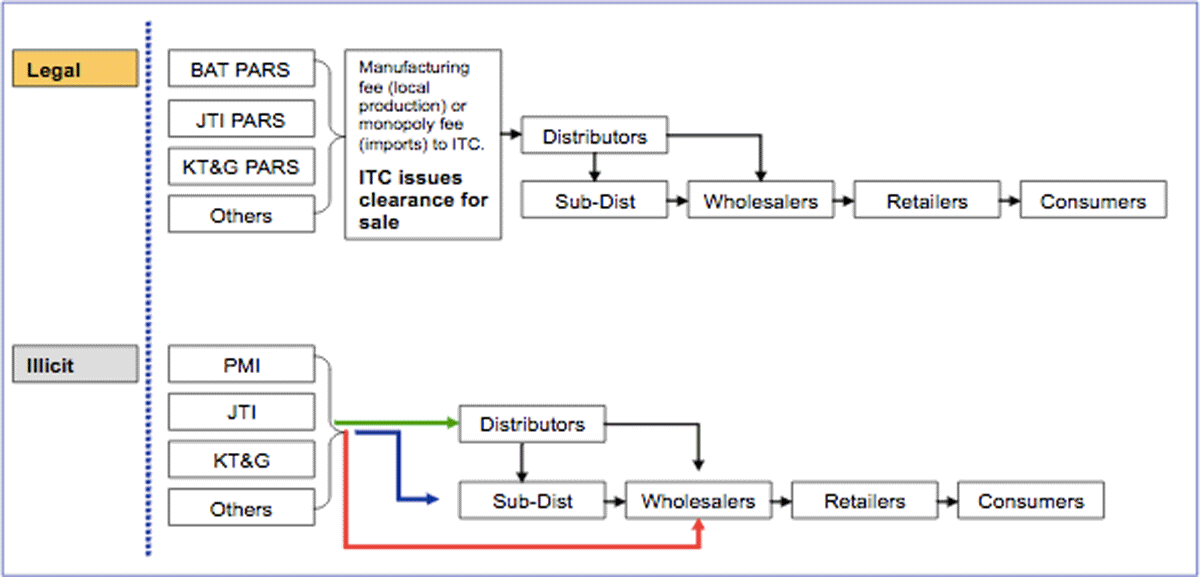

Internal documents describe BAT’s activities in Iran, including its business model and relationship with the Iranian Tobacco Company (ITC). Many of these involved engaging with authorities, including regarding manufacturing, and the payment of taxes and other fees (Figure 1), in addition to the company’s lobbying campaign, described internally as “Continued systematic engagement” centred on “reputation” (BAT 2010a; BAT 2006).

Figure 1 : Legal and illicit tobacco product supply chain in Iran, as described in an internal BAT document. Source: BAT. AIT Business Case – Iran, July 2010.

Meanwhile, according to the documents we reviewed, BAT remained potentially involved in ITT after agreements were signed with Iranian authorities to curb smuggling in 2002, with its brands – including duty free products – continuing to be diverted to illegal markets, and the company relying on a large network of distributors, partnering with companies based in free trade zones (FTZ), and generally failing to control its supply chain.

This is reminiscent of industry tactics uncovered in the 1990s and 2000s (UK Parliament 2000a; UK Parliament 2000b; NSRA 2003; ICIJ 2000). While BAT engaged with government authorities to tackle ITT, such activities appear to have primarily been for reputational and commercial purposes.

Potential continued involvement in smuggling

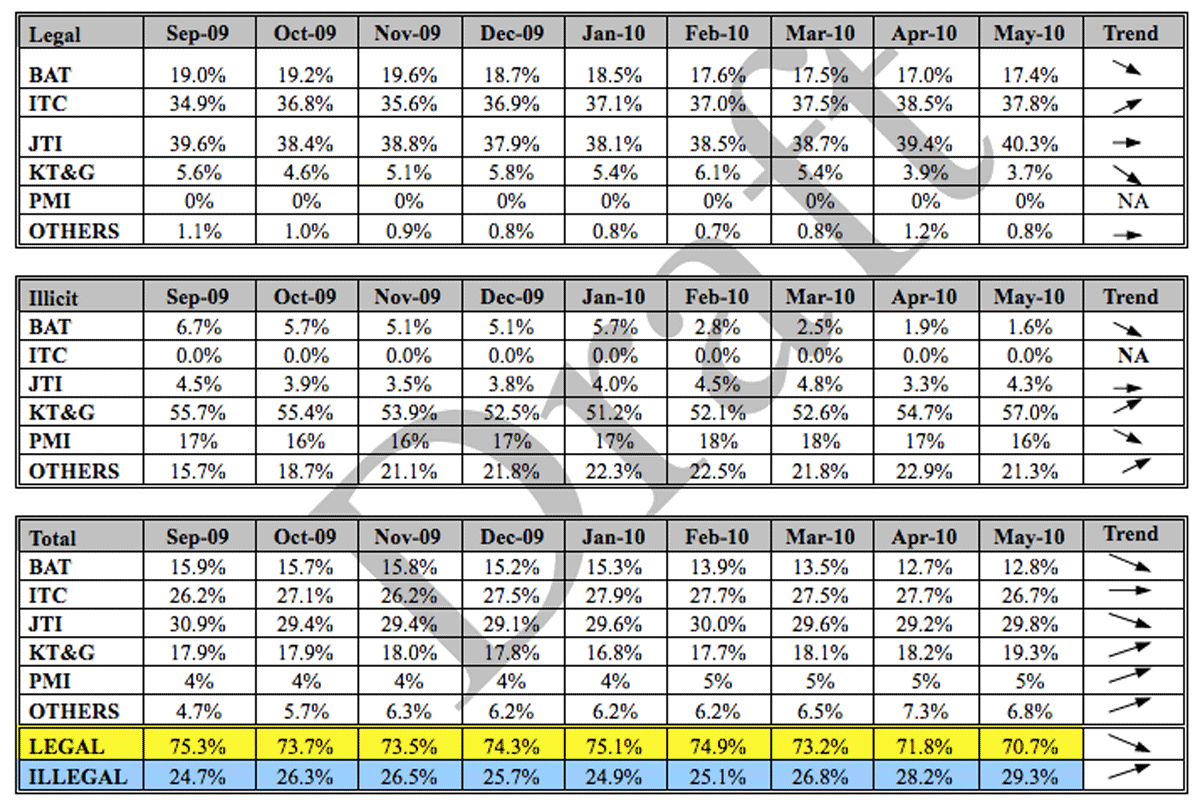

In response to the massive quantities of TTC products smuggled into the country in the 1990s, BAT signed an agreement with the state authority in 2002 to manufacture and import tobacco products legally in Iran (Albawaba 2002). Yet, internal documents suggest that BAT’s own products continued to be smuggled after that; Table 3 notably shows the illicit market share for BAT and other TTC brands, with BAT illegal sales accounting for 6.7% of the country’s illicit tobacco market in September 2009, according to the company’s own estimates (which are to be taken with precaution given commercial incentives to potentially underplay those figures, even internally). Broader evidence points to the company’s lack of control over its supply chains (UKFTT 2017: Paragraph 65). For instance, an investigation by the UK’s His Majesty’s Revenue & Customs (HMRC) focused on BAT oversupplying products to the Benelux markets, leading to diversion to illicit trade back to the UK, as a result of which BAT was fined £650,000 in 2014 (Doward 2014). The tribunal proceedings show that after examining the inner workings of the company’s anti-illicit trade units, HMRC concluded that BAT “did not investigate the smuggling of genuine product”, nor did the company “consider genuine products that are smuggled back into the UK from abroad as an area of legitimate concern” (UKFTT 2017: Paragraph 65; Paragraph 212). Internal documents show that duty free products and FTZs presented particular vulnerabilities for diversion of BAT products to illegal markets (BAT 2010b; BAT 2010c).

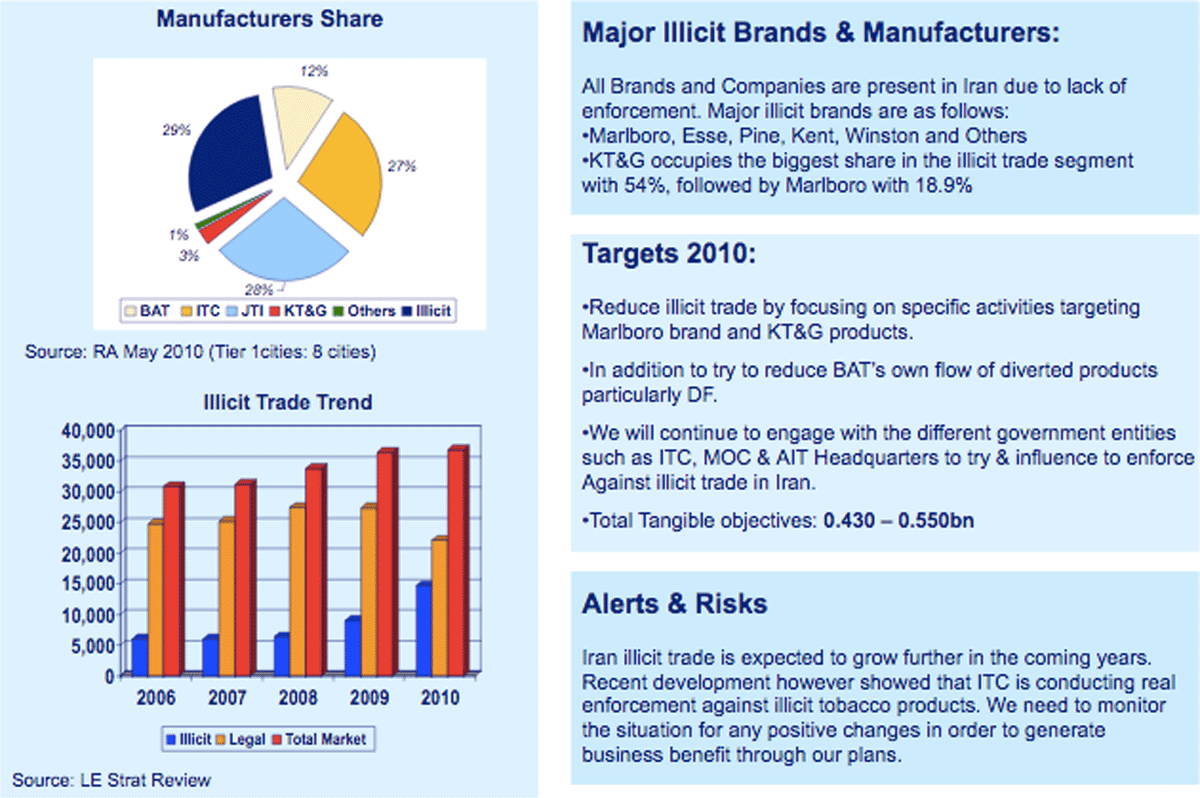

Overview of Iran’s illicit tobacco trade

Significant volumes of products from BAT and other TTCs were diverted from the legal supply chain to the illegal market in Iran (Tables 2, 3). “Illicit trade in Iran continues to be a major problem”, a May 2010 internal BAT report noted, pointing to “Korea Tobacco & Ginseng Corporation (KT&G), Japan Tobacco International (JTI), PMI [Philip Morris International], diverted BAT and other products” as the “main illicit brands” (BAT 2010b). Smuggled genuine TTC products represented the vast majority of ITT in Iran in 2009 and 2010, with counterfeit products accounting for only 2.9% and 3% of the illicit market in those years, as calculated from internal BAT estimates (0.26 billion and 0.44 billion of counterfeit products in 2009 and 2010, out of an illicit cigarette consumption of 8.9 billion and 14.72 billion sticks – see Table 2) (DOJ 2023a). It is noteworthy that these figures, albeit specific to Iran, clash with the industry’s disproportionate focus on counterfeiting in their public engagement efforts on illicit trade (Tobacco Tactics 2021; Fooks et al. 2014; Rowell et al. 2014). TTCs indeed often publicly claim, directly or through commissioned research and other allies, that much of ITT is made up of competitor products, namely, counterfeits and cheap whites, thus steering attention away from their own involvement in smuggling – despite even TTC-funded studies finding that smuggling of tobacco industry brands continue to account for the largest category of illicit consumption (Tobacco Tactics 2023; KPMG 2023).

Table 2 : BAT estimates of illicit trade. Source: BAT. Middle East Area, July 2010.

Table 3 : Internal BAT draft table estimating legal and illicit market shares of the main TTCs in Iran (September 2009–May 2010).Source: BAT. AIT Business Case – Iran, July 2010.

An internal BAT document from July 2010 focused on PMI and KT&G’s brands in ITT, states that the two companies occupied “the highest share in the illicit segment” at the time: “PMI has no legal presence in the market and all their products are smuggled into the market” (a few months later, a license was issued authorizing PMI to sell cigarettes in Iran (New York Times 2010), with ITC and PMI later signing a joint agreement to produce Marlboro cigarettes (Mehr News Agency 2018). The document added: “almost 75% of [KT&G’s] products available in the market are illicit, supplied through their local agent” (BAT 2010a). BAT’s figures in Table 3 are unverifiable and should therefore not be taken at face value. However, other independent studies have indicated that TTC brands account for the overwhelming majority of Iran’s illicit cigarette market (Batmanghelidj 2012).

BAT cigarettes diverted to illegal markets: the case of duty-free products and Free Trade Zones (FTZs)

Though BAT’s products may not have been smuggled in similar volumes as KT&G’s or PMI’s (see Table 3), an internal BAT document produced by the company’s Africa and Middle East AIT team in 2010 stressed the importance of “Monitoring (…) BAT’s diverted products particularly GTR [BAT’s Global Travel Retail department, primarily responsible for duty free products] products into ME [Middle East] area (Iraq and Iran in particular) and coordinate with BATI [BAT Iraq] to reduce it” (BAT 2010b). A similar document from July 2010 pointed to the need to “try and reduce BAT’s own flow of diverted products particularly DF [Duty Free]” (BAT 2010c) (see Figure 2).

Figure 2 : Internal BAT overview of ITT in Iran. Note on producers: Marlboro (PMI), Esse, Pine, and Winston (JTI), Kent (BAT). Source: BAT. Middle East Area, July 2010.

In the 1990s, FTZs served as conduits to ITT of BAT products. According to an internal BAT document in the early 1990s, a new route for their products was developed through Kish Island, where “goods are transferred by motor launch to the mainland” (BAT 1992). Given the broader context of BAT’s activities in the region then, “one might reasonably conclude that BAT’s interests in Kish Island was a channel for smuggling”, a WHO report noted in 2001 (WHO 2001).

According to the more recent internal documents we analysed, BAT continued to partner with companies based in FTZs. The company worked with a large business conglomerate involved in cigarette distribution and manufacturing in the Qeshm Free Zone, later targeted by US sanctions (Abell 2020). BAT supplied cigarettes to the Al Aqili Group for distribution in Iran and Iraq before relations reportedly deteriorated and were officially terminated with regard to Iran in November 2006 and Iraq in March 2008 (BAT 2016; Casemine. Khosravi v British American Tobacco PLC & ORS). Several years later, in April 2014, the US Treasury sanctioned Saeed Al Aqili, co-owner, Vice Chairman, and CEO of the Al Aqili Group “for providing support in connection with deceptive oil deals for Iran (…) in evasion of sanctions”, as well as the Al Aqili Group “for being owned by Saeed Al Aqili” (TREAS 2014). In 2021, BAT sold its Iranian subsidiary to another FTZ-based company (BAT 2023a).

The tensions between the objectives of the trade and AIT teams are worth mentioning here; for instance, the challenge of maximizing sales, including through de-regulated channels like duty free and FTZs, versus the goal of decreasing diversion to illicit trade to create “contestable space” to be captured by additional legal BAT sales (BAT 2011b). Indeed internal documents from BAT sales, trade, and marketing executives would perhaps prove even more useful in shedding light on the company’s business practices.

BAT’s misleading anti-illicit trade efforts

BAT’s AIT efforts in Iran followed a logic of boosting the company’s own reputation and growth. In 2006, Iran ratified the WHO Framework Convention on Tobacco Control. Its article 5.3 and guidelines aim to guard against tobacco industry interference. Yet, internal BAT documents laid out the extensive engagement strategy the company put in place to lobby the government on ITT, in clear violation of article 5.3.

A July 2010 BAT AIT memo described “actions to date” taken by BAT Pars and BAT’s Middle East Area Office. These actions included: “Continued systematic engagement” with various government entities including ITC, the Ministry of Commerce (merged into the Ministry of Industries, Mines and Trade in 2011), the Anti-Smuggling Department in the President’s Office, and police and customs officials to raise awareness on ITT; pressing authorities to address the flow of smuggled KT&G products; hosting an AIT conference in Tehran; funding and implementing a retail awareness campaign with the Iranian Guilds Association; and assisting authorities with intelligence gathering, information sharing, and support with seizures (BAT 2010a).

In addition to targeting competitors (including KT&G), the company’s engagement efforts with Iranian authorities on ITT appear to have been largely designed for reputational purposes. A 2006 internal BAT memo indicated “there is a need to build reputation on AIT” and for “concentrated efforts on reputation” (BAT 2006).

After BAT ramped up its engagement on ITT with government authorities, a series of tobacco taxes were decreased or eliminated, apparently in an attempt to mitigate smuggling (BAT 2011c). It is unclear whether BAT’s AIT lobbying played a role in those decisions, but this would be consistent with industry strategy (Schwartz 2019).

The rise and fall of BAT in Iran

With weakened competitors, increased interactions with the government, and lower cigarette taxes, BAT was able to greatly benefit from its AIT strategy, which was part and parcel of the company’s consistent push for growth in Iran. In 2006, the company’s finance director stated that thanks to strong sales in the country, Iran was now a “quite substantial” contributor to BAT, before adding: “The only significant risk is the political risk (…) of operating there” (Bowers 2006). An internal 2007 document noted that “Iran volatility (…) might divert attention from growth to survival” (BAT 2007). The company’s stated “mitigation plan” consisted of “accelerat[ing] recruitment”, in other words, doubling down on its expansion strategy (BAT 2010c). BAT’s country manager in Iran told an internal company magazine in October 2011 that BAT Pars had “experienced many ups and downs in a very complex business environment” before boasting about the “growing volumes and market share” (BAT 2011a).

In recent years, BAT experienced significant growth in Iran, making the company the second largest TTC in market share behind JTI (GlobalData 2020). As of 6 August 2021, BAT Pars relied on 326 direct employees, 1,192 contractors, and 54 sub-agents who sold BAT products to wholesalers and retailers (BAT 2023a). In 2020, BAT reportedly sold 11.4 billion cigarettes in the country, with an approximately £170 million revenue and £60 million profit (BAT 2021).

Yet the country’s “very complex business environment” ultimately led to the company’s demise in the country. BAT’s 2019 annual report to the US Securities and Exchange Commission included the fact that Iran is a country subject to sanctions, which “expose the Group to the risk of significant financial costs and disruption in operations that may be difficult or impossible to predict or avoid or the activities could become commercially and/or operationally unviable” (BAT 2022). Two years later, the company announced it “agreed to dispose of” its Iranian subsidiary (BAT 2023a).

Discussion

The analysis of internal BAT documents presented here highlights three key findings. First, even after signing legal agreements to curb smuggling of TTC products in the early 2000s, BAT’s brands continued to be smuggled, with developments reminiscent of industry tactics uncovered in the late 1990s and the early 2000s. These included duty-free BAT products diverted to illegal markets, with the company’s AIT employees monitoring those activities and trying to stop them. BAT also continued partnering with companies based in FTZs, despite historical evidence of links between these zones and smuggling (European Parliament 2017; Holden 2017). Broader evidence indicates BAT failed to put in place effective internal measures to control its own supply chain, including a clear internal division of labour regarding AIT or a comprehensive track and trace system (UKFTT 2017: Paragraph 65: Paragraph 212). This complements recent studies indicating that ITT incidence in Iran remains high and that smuggled TTC brands continue to account for the bulk of it (Tobacco Asia 2018; Poorolajal et al. 2017; Heydari 2018).

Second, our findings, along with BAT’s track record in other countries, including the recently uncovered sanctions-busting scheme in North Korea, may lead authorities to consider whether BAT’s activities in Iran require further investigation. In 2012, Esfandyar Batmanghelidj, then a Senior Research Associate at the Iran Tobacco Research Group, pointed out that “American tobacco companies have impressively tailored their operations in Iran to maximize profit, largely by engaging in illicit practices” and operated in “the Iranian market under conditions not permitted by their Iran operations licenses” (Batmanghelidj 2012).

OFAC reporting requires companies to provide detailed information on transactions across their supply chain, at least parts of which tobacco companies have historically deliberately kept opaque (Hiscock & Bloomfield 2021). In 2018, the US government re-imposed sanctions against Iran that had been waived under the 2015 multilateral nuclear accord (Joint Comprehensive Plan of Action), and later imposed new sanctions (CRS 2022). Three sectors particularly relevant to BAT’s activities in Iran – manufacturing, banking, and shipping – have been targeted, while the company may also be suspected of conducting business with some of the many individuals listed in US sanctions (TREAS 2023; White House 2018; White House 2020). Documents notably point to BAT’s main distributor in Iran being targeted by sanctions years after the two companies cut ties (BAT 2016; Casemine. Khosravi v British American Tobacco PLC & ORS; TREAS 2014). In the context of the recently uncovered scheme in North Korea, a business model akin of BAT in Iran may warrant further examination. This model relied on extensive engagement with government authorities, a loosely controlled supply chain with a high number of local distributors and contract workers, and an AIT strategy more focused on maximizing growth and reputation.

Third, the company extensively engaged with the Iranian authorities, in clear violation of the Framework Convention’s Article 5.3, which aims to protect tobacco control policies from “commercial and other vested interests of the tobacco industry” (WHO FCTC 2013). In practice, available evidence suggests those efforts focused on creating more growth opportunities for BAT and improve the company’s reputation. BAT achieved significant economic success in Iran, but the company ultimately agreed to leave the country in 2021.

Limitations and strengths

The source of the internal documents reviewed and analysed was a single ex-BAT official. For this reason, the dataset does not include potentially relevant communications within the company that they were not privy to. In addition, the documents cover 2000–2014, and hence do not offer any insights on more recent years when new US sanctions were imposed and Iran banned cigarette imports. Nonetheless, the documents do include substantial quantitative and qualitative material, providing helpful insights into BAT’s failure to address ITT and the company’s relations with authorities, and important context for any potential future investigation.

Implications

BAT’s products, sold legally or otherwise, killed thousands of Iranians, undermined tobacco control measures, and burdened its public health system. Tobacco-induced diseases killed almost 40,000 people in Iran in 2016 alone (Tobacco Atlas 2021). BAT’s cigarettes sales in Iran in 2020 alone could lead to over 11,000 deaths (based on estimates that one death results from each million cigarettes sold) (Jha & Peto 2014). New evidence presented in this paper of, at best, BAT’s failure to secure its supply chains and, at worst, the company’s potential continued involvement in smuggling over the timeframe of the dataset (2000–2014) demonstrates the hypocrisy of the industry’s rebranding efforts and PR-driven rapprochement with governments and international organizations to tackle ITT.

BAT and other TTCs continue to operate in countries under sanctions, have only left following significant pressure over time, or in the case of BAT in North Korea, claimed it stopped doing business in the country in 2007 yet continued to operate illegally for another decade. PMI’s CEO admitted in February 2023 the company may never leave Russia (Barnes 2023), with JTI also deciding in November 2023 it would continue to do business in the country “in order not to deprive consumers of the product to which they are accustomed” (Pravda 2023).

This paper aimed to provide an understanding on BAT’s operations in one of these countries, Iran. Future investigative journalism and academic research on the topic may be guided by the following questions: What led to BAT’s decision to sell its Iranian subsidiary? What has been the extent of BAT and other TTC participation in ITT in Iran since agreements were signed with authorities in the early 2000s? To what extent can other case studies of TTC activities in countries facing sanctions (e.g., Russia, Belarus, Myanmar) provide a potential window into the patterns of TTC behaviour in those systems? What are the implications for populations in those countries, TTCs themselves, and global tobacco control?

Source: JIED